The Federal Reserve has to keep an eye on a lot of things, but one of the most important is inflation. When inflation is too high, it can lead to recession.

With Fed funds rates raising and inflation at stubbornly high levels, the question becomes will the Fed need to take us into a recession? If so, what does that mean on many fronts.

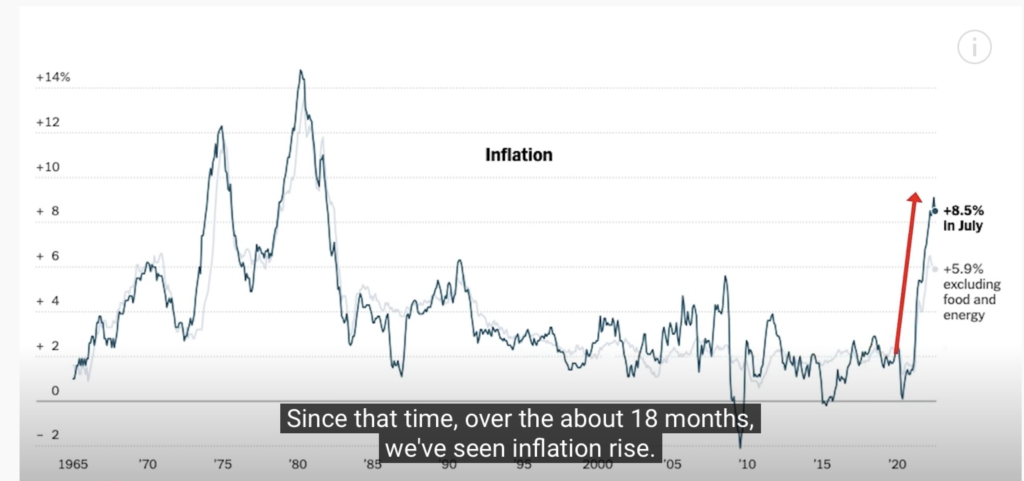

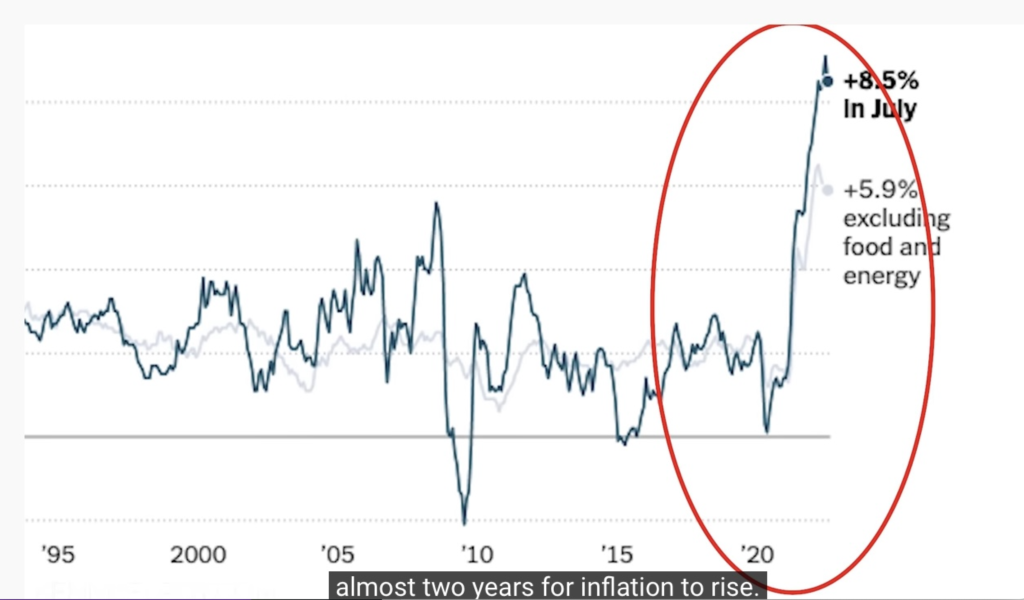

Inflation makes 100% of the people poorer because it erodes incomes and savings accounts. What’s most important to notice in this chart is that it has taken almost two years for inflation to rise.Just as it takes a while for it to creep up and it will also take a while for it to creep back down to the 2% target rate.

It appears after this past week of the Fed meetings that the Fed is going to continue to raise rates as their answer to combat inflation.

Along with that they will drive up unemployment and begin a tip towards recession. Recession is a significant and persistent decline in economic activity. It may last as little as a few months.

As Fed rates continue to increase it impacts the cost of money to the financial institutions and they then raise their rates of lending to those companies building or manufacturing. This in turn impacts the number of new homes being built and the cost of those homes as well. You may in fact have seen where KB Homes, Hovanian, DR Horton and others have stopped or slowed the steady building they have been doing over the past two years.

What this is doing for you as a buyer is increasing the inventory of homes to choose from at a lower price than a year ago.

If you currently are in your home make sure you have a fixed interest rate and if you don’t let’s talk about getting it fixed for you.

If you have concerns around the economy going into a recession, watch for next weeks blog to learn tips on how to protect yourself during an economic downturn.