The cost of renting versus buying a home is a topic that comes up frequently.

What is the better financial decision????

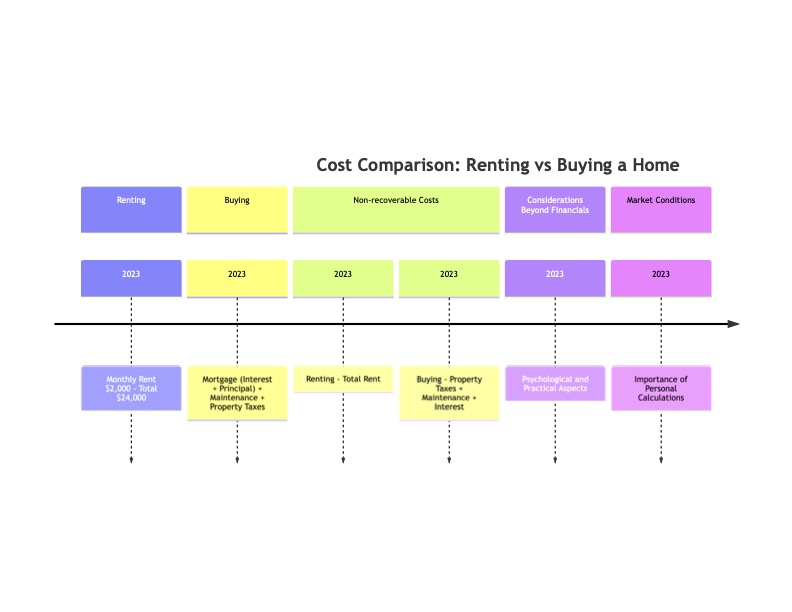

With renting, the total cost is just the amount that you give your landlord, which you never see again. For example, if rent is $2,000 a month, over twelve months, that’s $24,000 a year gone. The total cost of owning a home includes a mortgage payment, which is comprised of interest and principal, plus miscellaneous costs like maintenance per year. To make an apples-to-apples comparison, we need to figure out how much money we’ll never get back in both scenarios. The main goal is to determine the cost of home ownership on a monthly basis to compare it to renting costs and decide which option is better.

If the monthly cost of home ownership is cheaper than renting a comparable home, then buying might be the better option, and vice versa. The components of home ownership include property taxes, maintenance costs, and the mortgage payment, with the mortgage being split into interest and principal components. Ownership costs that renters avoid include property taxes and maintenance costs. Property taxes are due annually based on property value, and maintenance costs are recommended to be set aside annually for upkeep.

For a hypothetical $500,000 home, property taxes and maintenance costs are calculated based on percentages of the home’s value, resulting in annual costs that are considered non-recoverable investments. The mortgage aspect involves financing the majority of the home’s value after a down payment, commonly over 30 years. The cost of the mortgage, or the cost of capital, includes both the opportunity cost of the down payment and the interest payments on the loan.

The opportunity cost represents the potential earnings from investing the down payment elsewhere, and the interest payments represent the cost of borrowing. The total annual cost of ownership, including the opportunity cost and interest payments, can be calculated and then broken down into a monthly cost. This allows for a comparison between the monthly cost of owning and renting a home.

A rule of thumb is presented for quickly estimating the monthly cost of home ownership based on the home’s value, property taxes, maintenance costs, and the cost of capital. This calculation can help determine if renting or buying is more financially advantageous under current conditions.

Additionally, considerations beyond financial calculations, what feels right to you as you acknowledge that decision-making may not always be rational and may be influenced by personal circumstances and preferences.

In other words, that each option has its own set of benefits and drawbacks. The importance of running personal calculations to determine the best choice for one’s situation is important, along with the notion that changing market conditions can affect the renting versus buying decision.

In A Nutshell . . .

There are calculations that show you by the numbers which is best for you renting or buying a home. Additionally, what is not often mentioned but is very true, is the taxes and interest paid when buying a home are not entirely lost because they are tax deductible. When you rent, nothing is tax deductible. Reach out to get accurate numbers for your scenario to see which direction is best for you at this time and in 1 year, 2 year or 5 years what may it look like.