Navigating Home Financing in Today’s Market

Buying a home is one of the most significant financial decisions you’ll ever make, and in today’s dynamic real estate market, understanding financing is key. With shifting interest rates, various loan options, and the importance of financial preparedness, being well-informed can make all the difference in securing the right home at the right price.

The Role of Interest Rates

Mortgage rates have been on a rollercoaster, influenced by economic trends and Federal Reserve policies. When rates are low, buyers can afford more home for the same monthly payment, often leading to increased competition and rising prices. On the other hand, higher rates can cool demand, sometimes opening up better negotiating opportunities. To make the most of your buying power, consider using mortgage calculators to see how different rates affect your budget and keep an eye on market trends to lock in a favorable rate.

Exploring Loan Options

Not all loans are created equal, and the right one can make a big impact on affordability. Government-backed programs like VA loans, FHA loans, and first-time homebuyer assistance often come with lower down payment requirements and more flexible credit standards. In a market where cash buyers have an advantage, these options can help make financing more competitive. Consulting with a trusted loan officer can help you navigate the best fit for your financial situation.

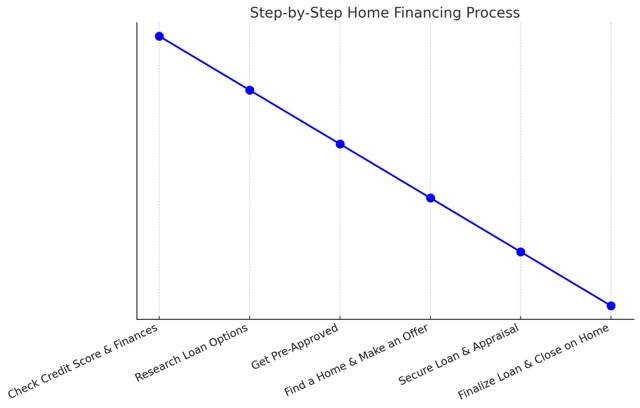

The Power of Pre-Approval

In a fast-moving market, pre-approval is more than just a formality—it’s a game-changer. Getting pre-approved for a mortgage signals to sellers that you’re serious and financially prepared, giving you a competitive edge over other buyers. It also helps you set a realistic budget and streamlines the closing process, reducing the risk of financing delays.

Why Credit Scores Matter

Your credit score plays a major role in determining your mortgage rate and loan eligibility. A higher score can mean lower interest rates, translating into thousands of dollars in savings over the life of your loan. Simple steps like paying bills on time, keeping credit card balances low, and avoiding new debt before applying for a mortgage can help strengthen your credit profile.

In A Nutshell . . .

Navigating the home financing process may seem overwhelming, but with the right knowledge and preparation, you can make informed decisions that set you up for success. Understanding interest rates, exploring loan options, securing pre-approval, and maintaining good credit are all key steps to homeownership in today’s market.

The good news? There are new and existing programs available to help ease some of the upfront costs of buying a home, from down payment assistance to lender incentives and special grants. If you’re curious about what might be available for your situation, feel free to reach out—I’m happy to share resources and help point you in the right direction.

Buying a home is a big step, but you don’t have to navigate it alone. Let’s connect and explore what options might work best for you!