Inflation’s Still Playing Hard to Get

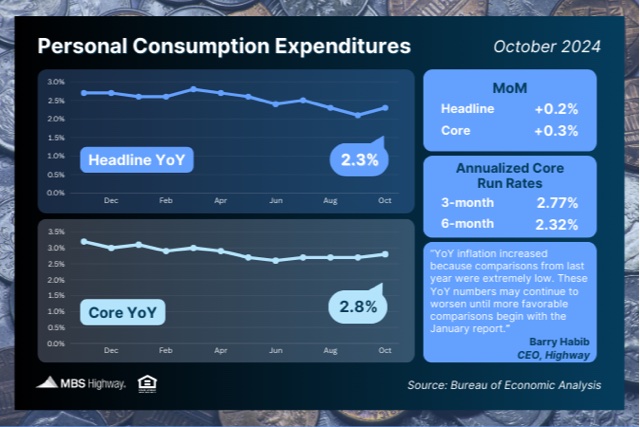

October’s inflation numbers are in, and it seems inflation isn’t quite ready to bow out of the spotlight. The Personal Consumption Expenditures (PCE) report showed that headline inflation edged up 0.2% from September, nudging the year-over-year rate from 2.1% to 2.3%. Meanwhile, Core PCE—aka the Fed’s favorite yardstick that skips food and energy prices (because apparently, no one eats or drives)—rose 0.3% for the month and ticked up year-over-year from 2.7% to 2.8%. Still, it’s near the lowest levels in over three years. Cue cautious applause.

What’s the story behind the numbers?

Yes, annual inflation moved slightly in the “wrong” direction—kind of like that one step back when you’re learning a new dance move. But don’t panic! Part of the increase is just October 2023’s unusually low figure exiting stage left from the 12-month calculation, replaced by October 2024’s more average 0.3%. Think of it like swapping out a salad for a burger in your calorie tracker—things are bound to look heavier.

Looking ahead, the silver lining is clear when you check out the trend in the chart below. January through April 2024 were already showing higher inflation figures, so as those months roll out of the 12-month calculation next year, the Fed may find itself inching closer to its elusive 2% target.

In A Nutshell . . .

As the chart shows, we’re not dealing with runaway inflation anymore, but the road to a consistent 2% is still a journey. Here’s hoping inflation decides to chill in 2024 (we won’t have 2024 year end numbers until February 2025)—maybe it just needs some mindfulness meditation!