The Impact of Election Years on the Real Estate Market

Presidential election years introduce unique dynamics into the housing market, primarily through three channels: uncertainty, policy expectations, and consumer confidence. These factors shape buyer and seller behaviors, influencing home sales, mortgage rates, and property values in nuanced ways.

1. Uncertainty and Volatility

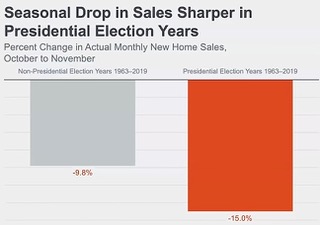

During election seasons, both buyers and sellers often become cautious, slowing down market activity. As shown in the slide below, there is a 15% drop in new home sales between October and November during election years, compared to a 9.8% decline in non-election years. This pattern reflects the heightened uncertainty as voters wait to see which policies and economic strategies will follow the election outcome.

Uncertainty affects not only transaction volume but also lending standards, as financial institutions adopt a more conservative stance, tightening mortgage approvals until policy directions become clear.

2. The Rebound After Elections

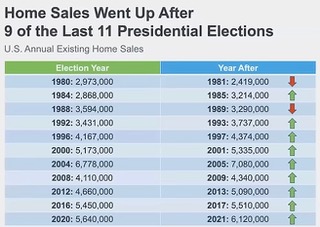

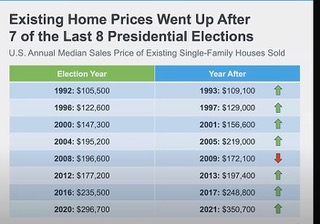

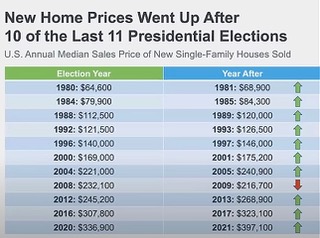

While the housing market may experience temporary slowdowns leading up to the election, history shows it tends to rebound quickly afterward. This trend is evident in the chart showing home sales going up in 9 out of the last 11 presidential elections. Buyers and sellers, now operating under clearer expectations about future policies, become more confident and engage more actively in the market

3. Policy Expectations and Market Sentiment

The quote from Al Lord, CEO of Lexerd Capital Management, underscores the significance of policy expectations in influencing real estate. Buyers, sellers, and investors pay close attention to candidates’ promises regarding tax reforms, housing incentives, and mortgage regulations, which can have far-reaching effects. If a candidate signals support for affordable housing programs, for example, it may spur buyer activity in anticipation of favorable changes.

At the same time, interest rate policies play a crucial role. Often, election years align with Federal Reserve efforts to stimulate economic growth, resulting in potential rate cuts. However, uncertainty can also create volatility, with mortgage rates fluctuating until the market stabilizes post-election.

4. Regional and Demographic Considerations

Not all areas respond the same way during election years. Urban markets, which are more sensitive to policy changes, may see sharper fluctuations, while suburban or rural areas tend to exhibit more stability. As seen in recent trends, suburban demand has grown, driven by remote work and lifestyle changes, a trend that may continue to shape housing preferences regardless of the election outcome.

In A Nutshell . . .