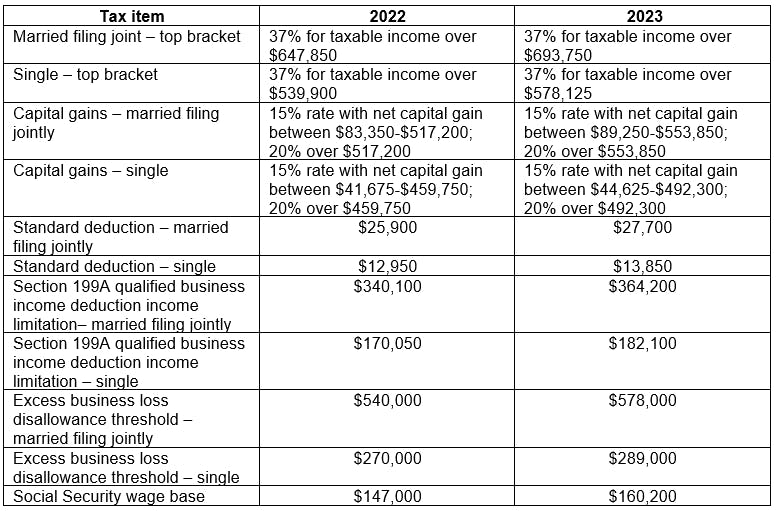

Multiple amounts in the Internal Revenue Code are tied to the chained Consumer Price Index and modified on an annual basis. After a year of inflationary increases, taxpayers can expect significant changes to a variety of tax thresholds in 2023. Besides adjusting tax brackets, inflation adjustments impact the section 199A qualified or business deduction, excess business loss threshold and the Social Security wage base, among others. Generally, the IRS releases final adjustments during the fall. Given the volatility of the prices the last few months, it’s possible that final adjustment information will be released later than normal.

Individual taxes

Remember, the thresholds for the net investment income tax (3.8% tax) and additional Medicare tax (0.9% tax) are not tied to inflation and remain at $250,000 for married filing jointly taxpayers, $125,000 for married filing separately taxpayers and $200,000 for other taxpayers.

While still a few years away, the individual tax environment will change (barring new tax legislation) after 2025 when provisions enacted under the Tax Cuts and Jobs Act (TCJA) expire. Key items include increasing the top tax rate for individual taxpayers back to 39.6%, ending the 20% section 199A qualified business income deduction, removing the $10,000 cap on the state and local tax deduction and reinstating the personal and dependent exemption deductions.