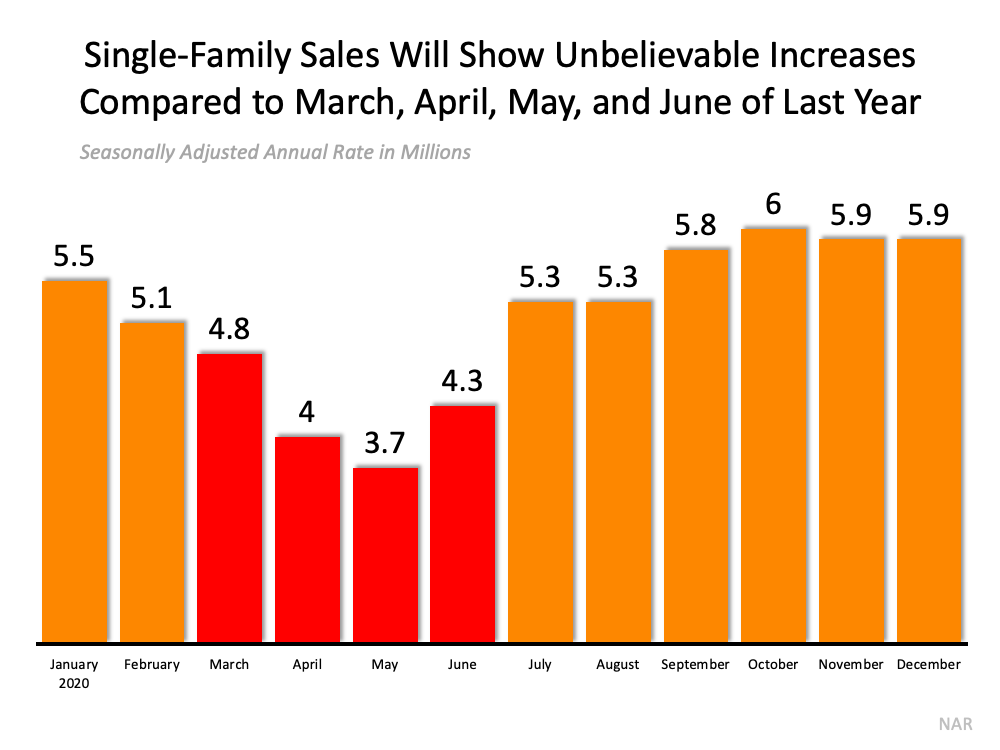

Don’t be impressed by the headlines reporting year-over-year housing numbers for the next several months (data covering March, April, May, and June). The data will most likely show eye-popping one-year increases.

While the year-over-year jumps will certainly be striking, you should take these numbers with a grain of salt, as the situation highlights a short-term quirk in the reporting of this data. Essentially, the increases will reflect a combination of two things: sharply lower housing numbers during last year’s virus-related market collapse and the subsequent strong rebound. This will result in what will appear to be unbelievable growth.

As the graph reveals, last spring’s buying market was anything but typical. Instead of sales increasing, they fell sharply as a result of stay-at-home orders that virtually shut the real estate industry down.

This spring’s real estate market will bounce back with more normal seasonal sales increases. The percentage increase in sales will be astronomical – not because sales have skyrocketed, but instead because they will be compared to last year’s low numbers.

No doubt …

There are likely to be some sensational headlines about real estate over the coming months. However, don’t be fooled. The actual story is that the real estate market is finally back to normal. And, this isn’t a bubble, it’s simply a lack of supply. Call or text for details on your situation.